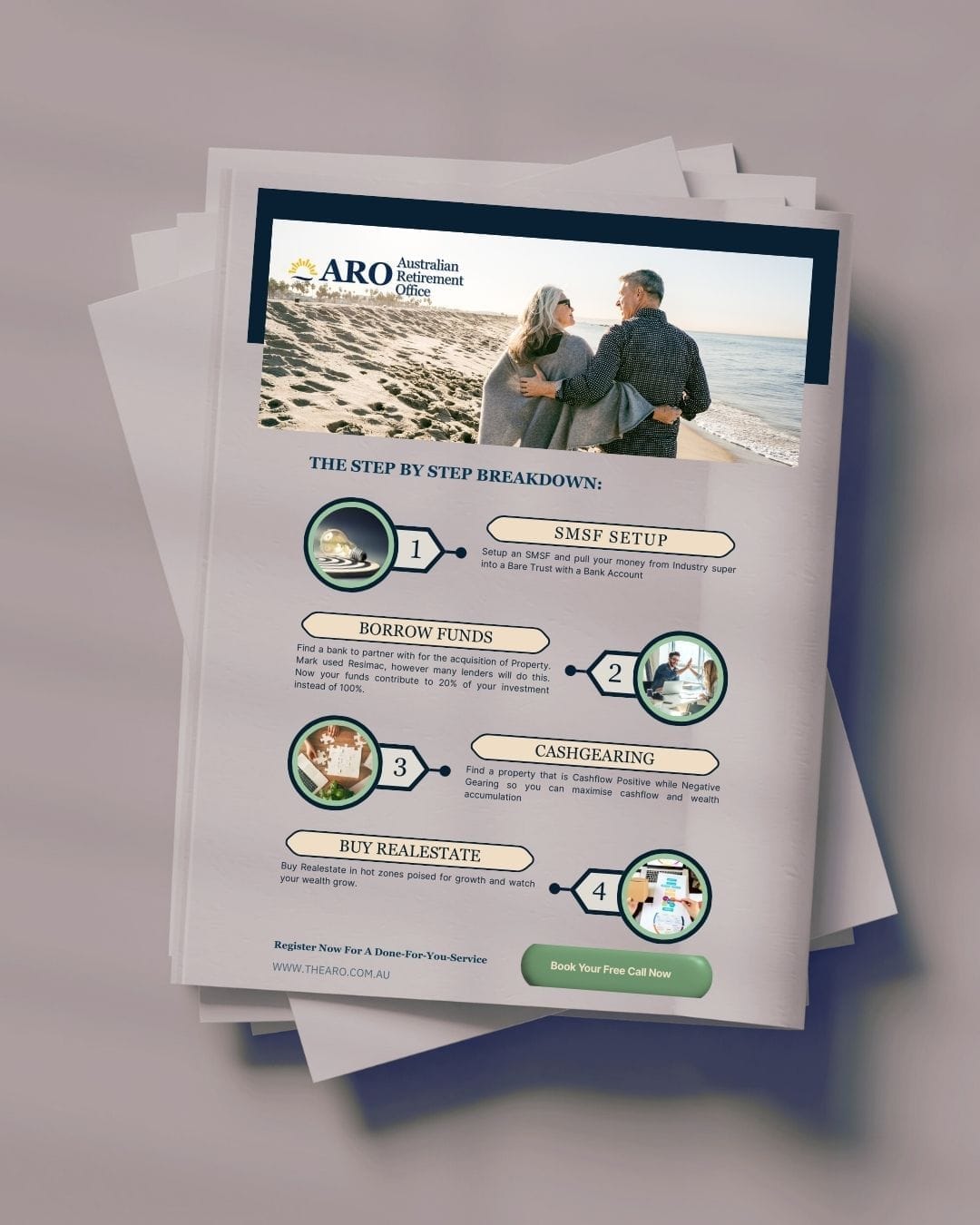

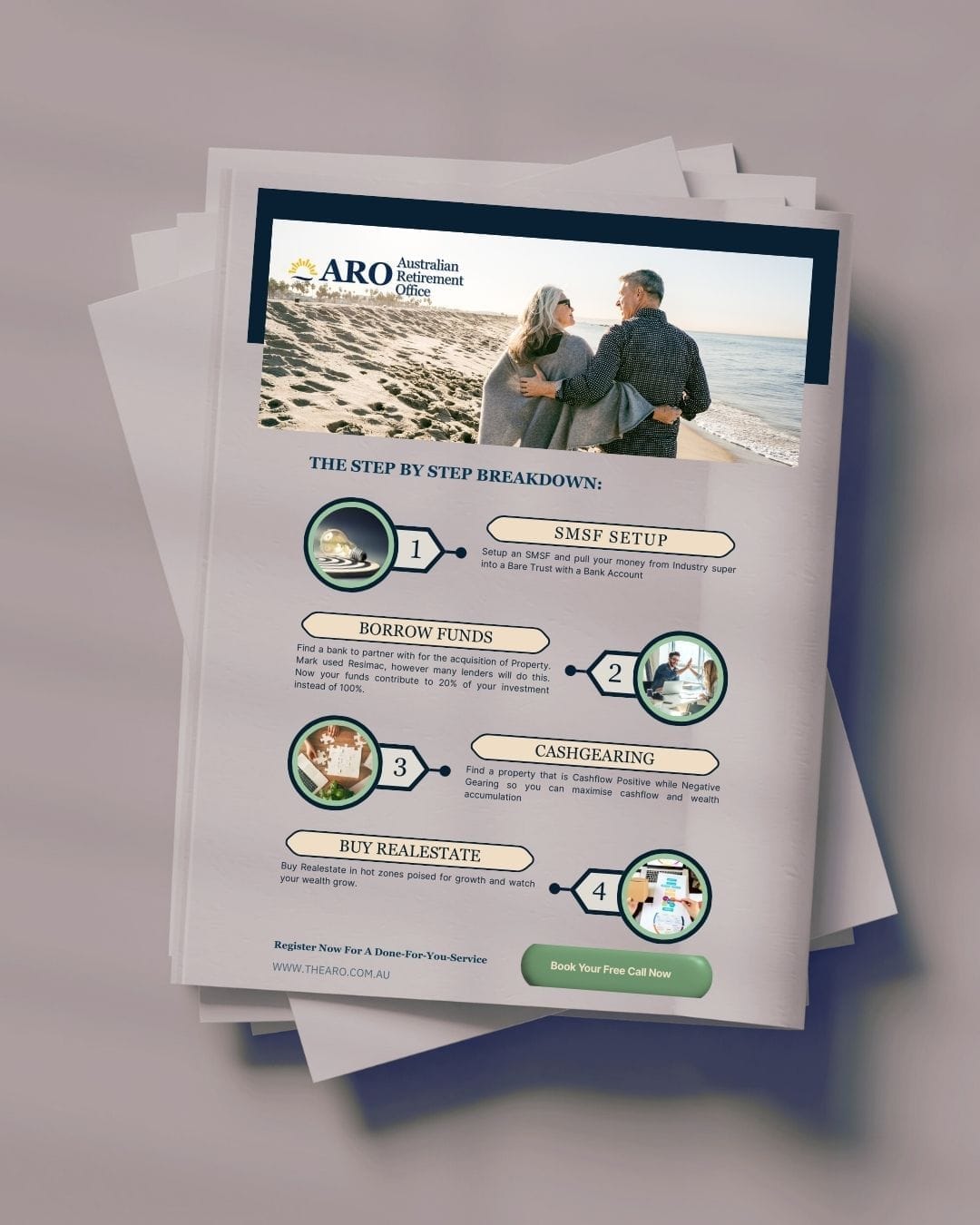

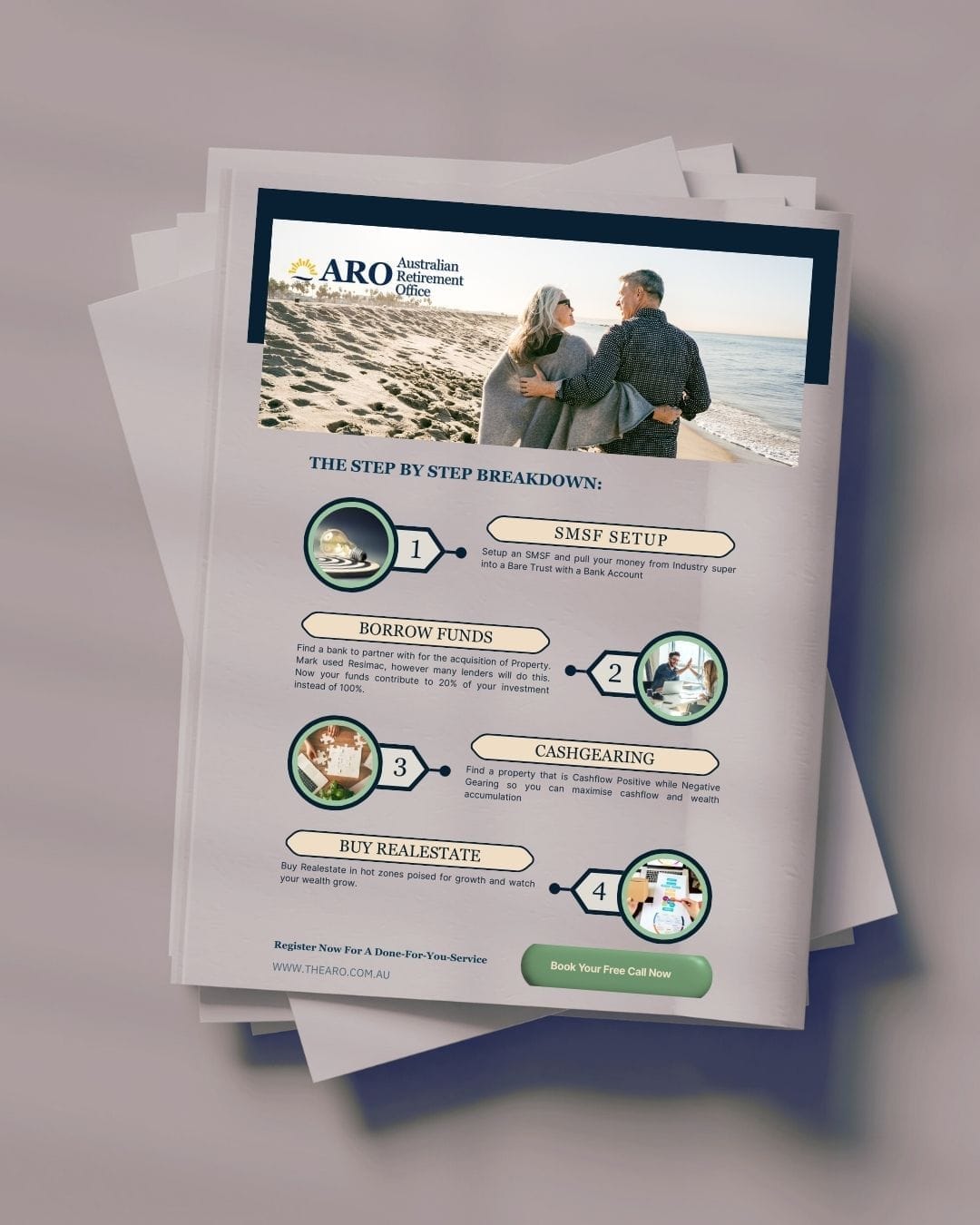

How property investing works with SMSF to accelerate wealth

Free 200K SMSF Case Study: See how one fund used leverage and property to add over $200,000 to its retirement balance in 18 months - and the exact steps they took

How property investing works with SMSF to accelerate wealth

Free 200K SMSF Case Study: See how one fund used leverage and property to add over $200,000 to its retirement balance in 18 months - and the exact steps they took

Free Case Study Download

A man in his 30s started an SMSF and doubled the balance in 18 months.

Discover the 5-step process that doubled his super balance within 18 months and how you can apply it today.

This case study SMSF grew 1428% faster than industry super. This does not take into consideration your personal situation. Each SMSF is different.

Education only. No product push. No obligation. Just a clear breakdown of how SMSFs combine property, tax and leverage – including the risks.

Here’s what you’ll get inside the Case Study

The exact leverage structure this SMSF used to buy two investment properties starting from a $200,000 balance, with simple diagrams and numbers.

How rental income, contributions and tax offsets worked together inside the fund to drive faster growth than a typical industry super scenario.

A side‑by‑side comparison of the SMSF’s projected returns vs leaving the same balance in an industry fund over the same period.

A practical checklist to help you quickly see whether a similar approach might be worth discussing with a mortgage broker and buyer's agent.

The key risks most people overlook with SMSF property and borrowing – including what can go wrong if you get the structure wrong.

Who this is for

This case study is for you if you:

You have at least $100,000–$200,000 in super (combined, including a partner) and 5–30 years until full retirement.

You’re curious whether buying property through an SMSF could legally and safely improve your retirement outcome.

You want to understand the strategy first, in plain English, before taking any formal steps.

It's not for you if

You’re looking for guaranteed returns or a get‑rich‑quick scheme.

You’re not willing to take on investment risk, paperwork or SMSF responsibilities.

Why SMSF + Property

Why many Australians look beyond industry funds

Industry funds are built for simple, set‑and‑forget investing across diversified portfolios, which suits many people. But they don’t usually allow you to borrow to invest, choose your own direct properties, or tailor strategy around your specific tax situation.

An SMSF can offer more control – including the ability to use limited‑recourse borrowing to buy property and to align strategy with your broader wealth and tax planning – but it also comes with extra cost, complexity and trustee obligations.

The case study walks through how one SMSF used these tools – and the trade‑offs involved – so you can make a more informed decision before seeking licensed advice.

Who is Australian Retirement Office?

Australian Retirement Office (ARO) helps Australians understand how to use SMSFs, property and tax strategies to retire with more clarity, control and confidence. ARO provides general and educational content only and works alongside licensed financial advisers, tax agents and lenders where personal advice is required.

Our role is to demystify the strategy – not sell you a product. When you download the case study, you’ll get education you can take to your existing adviser or use as a starting point for a more detailed conversation.

Why Most Australians Retire With Less Than They Should

For decades, Australians have been told to trust industry funds. But here’s the truth:

You can’t borrow to magnify your returns.

You don’t own property directly.

You miss out on key tax offsets that could keep more money in your pocket.

Download the 200K SMSF Case Study

Compliance Statement

The information provided by Australian Retirement Office is general in nature and educational only. It does not constitute financial product advice, legal advice, or taxation advice, and does not take into account your objectives, financial situation, or needs.

Australian Retirement Office does not hold an Australian Financial Services Licence (AFSL). Where appropriate, we may refer you to licensed professionals within our partner network. We may receive referral fees for these introductions.

All investments carry risk, including potential loss of capital. Case studies and examples are provided for illustrative purposes only. Past performance is not a reliable indicator of future returns.

You should obtain professional advice and review all relevant Product Disclosure Statements (PDS) before making any financial decisions.

At the Australian Retirement Office (ARO), our mission is simple: to help Australians retire better.

We believe retirement shouldn’t be left to chance or hidden inside industry super funds with limited control. For decades, Australians have built wealth through property, business, and smart tax strategies. That’s exactly what we help our clients bring into their super.

With a focus on clarity, control, and confidence, ARO provides education and strategies that put the power back in your hands, so you can retire on your terms.

FOLLOW US

Where should we send the case study?